Delaware Global Value Fund and Delaware International Value Equity Fund,

each a series of Delaware Group®Global & International Funds

Delaware VIP®International Value Equity Series, a series of

Delaware VIP®Trust

Dear Shareholder:

I am writing to let you know that a joint special meeting (the “Meeting”) of shareholders of the Delaware Funds®by Macquarie funds listed above (each, a “Fund” and collectively, the “Funds”) will be held at the offices of [StradleyStradley Ronon Stevens & Young, LLP, 2005 Market Street, 26th26th Floor, Philadelphia, Pennsylvania 19103, on July 15, 2019, at 4:00 p.m., Eastern time].time. The purpose of the Meeting is to vote on two important proposals that affect each Fund and your investment in one or more of them. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your Fund(s). This package contains information about the proposals and the materials to use when voting by mail, telephone, or through the Internet.

Please read the enclosed materials and cast your vote on the proxy card(s) or by telephone or via the Internet. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

[The proposals have been carefully reviewed by the Boards of Trustees of the Delaware Group®Global & International Funds and Delaware VIP®Trust (each a “Trust” and together, the “Trusts”), which is comprised of eleven Trustees. The Trustees, all but one of whom are not “interested persons” of Delaware Funds, believe these proposals are in the best interests of shareholders.The Trustees recommend that you vote FOR each proposal.]

The enclosed overview is provided to assist you in understanding the proposals. Each of the proposals is described in greater detail in the enclosed Proxy Statement.

Voting is quick and easy. Everything you need is enclosed.To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign the card(s) before mailing it (them) in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the Web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded or online instructions.

If you have any questions before you vote, please call Computershare Fund Services (“Computershare”), the Funds’ proxy solicitor, at [Computershare Phone Number].888-916-1720. Computershare will help you get your vote in quickly. You may also receive a telephone call from Computershare reminding you to vote your shares. Thank you for your participation in this important initiative.

Sincerely,

|  |

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERSTo be held on [JulyTO BE HELD ON JULY 15, 2019]2019

To the Shareholders of:

Delaware Global Value Fund and Delaware International Value Equity Fund,

each a series of Delaware Group®Global & International Funds

Delaware VIP®International Value Equity Series, a series of

Delaware VIP®Trust

NOTICE IS HEREBY GIVEN that a joint special meeting (the “Meeting”) of shareholders of the specific series (each, a “Fund” and collectively, the “Funds”) within the open-end registered investment company listed above (each, a “Trust” and together, the “Trusts”) will be held at the offices of [StradleyStradley Ronon Stevens & Young, LLP, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103],19103, on [JulyJuly 15, 2019 at 4:00 p.m., Eastern time].time. The Meeting is being called to vote on the following proposals:

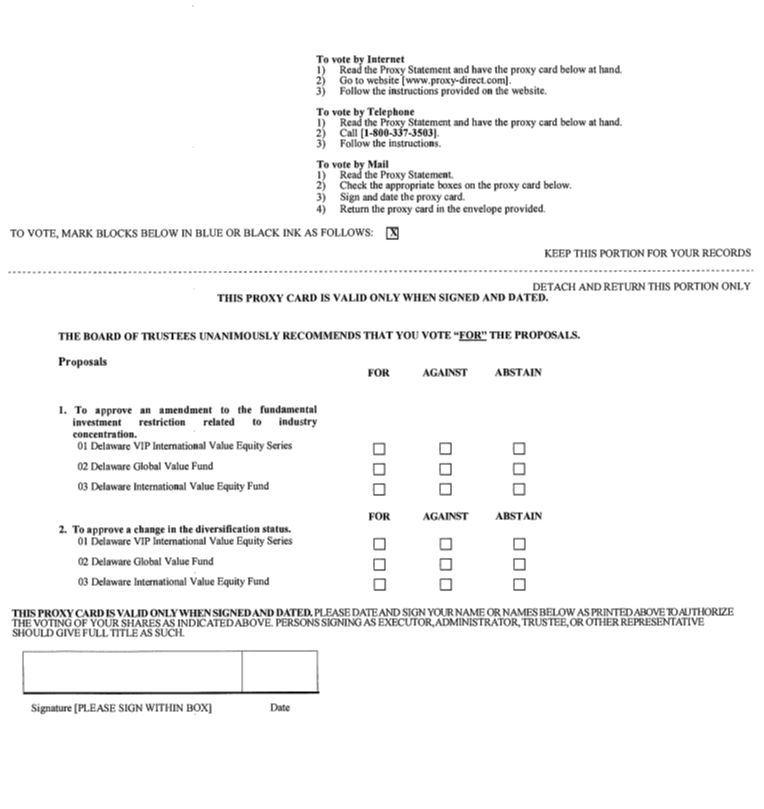

| 1. | To approve an amendment to the fundamental investment restriction related to industry concentration for each of the Funds. | |

| 2. | To approve a change in the diversification status of each of the Funds. |

Shareholders of record of the Funds as of the close of business on [MayMay 16, 2019]2019 are entitled to notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders must hold their shares as of the Record Date in order to be admitted to the Meeting.Whether or not you plan to attend the Meeting, please vote your shares by returning the proxy card(s) by mail in the enclosed postage-paid envelope provided, or by voting by telephone or over the Internet. Your vote is important.

By order of the Board of Trustees,

Shawn K. Lytle

May 23, 2019]2019

To secure the largest possible representation and to save the expense of further mailings, please mark your proxy card(s), sign, and return it (them) in the enclosed envelope, which requires no postage if mailed within the United States. If you prefer, you may instead vote by telephone or the Internet. You may revoke your proxy at any time before or at the Meeting or vote in person if you attend the Meeting, as provided in the attached Proxy Statement.

SHAREHOLDERS WHO HOLD SHARES IN MORE THAN ONE FUND WILL RECEIVE PROXY CARDS AND/OR PROXY MATERIALS FOR EACH FUND OWNED. PLEASE SIGN AND PROMPTLY RETURN EACH PROXY CARD IN THE SELF-ADDRESSED ENVELOPE REGARDLESS OF THE NUMBER OF SHARES OWNED.

| BRIEF OVERVIEW |

| PROPOSAL 1: CHANGE THE FUNDAMENTAL INVESTMENT RESTRICTION RELATED TO INDUSTRY CONCENTRATION. | 5 | |

| VOTING INFORMATION |

| How will shareholder voting be handled? |

| How do I ensure my vote is accurately recorded? |

| Who is entitled to vote? |

| What is the |

| What is the required vote for each |

| Who will pay the expenses of the |

| What other solicitations will be made? |

| Why did my household receive only one copy of this |

shareholder meeting? |

| How may I communicate with the |

| MORE INFORMATION ABOUT THE FUNDS |

| PRINCIPAL HOLDERS OF SHARES |

| APPENDICES TO PROXY STATEMENT |

| APPENDIX A – NUMBER OF SHARES OF EACH FUND OUTSTANDING |

i

|  |

DELAWARE FUNDS®BY MACQUARIE

JOINT PROXY STATEMENT

DATED MAY 23,

Delaware Global Value Fund and Delaware International Value Equity Fund,

each a series of Delaware Group®Global & International Funds

Delaware VIP®International Value Equity Series, a series of

Delaware VIP®Trust

This joint proxy statement (the “Proxy Statement”) solicits proxies to be voted at a joint special meeting of shareholders (the “Meeting”) of the specific series (each, a “Fund” and collectively, the “Funds”) within the registered open-end management investment companies listed above (each, a “Trust” and together, the “Trusts”), which are issuing proxy solicitation materials. [TheThe Meeting was called by the Boards of Trustees of the Trusts (collectively the “Board”) to vote on the following proposals (each, a “Proposal” and collectively, the “Proposals”), each of which is described more fully below]:

Proposals | Who votes on the Proposals? | |||

| 1. | To approve an amendment to the fundamental investment restriction related to industry concentration. | Shareholders of each Fund, voting separately from shareholders of each other Fund. | ||

| 2. | To approve a change in the diversification status. | Shareholders of each Fund, voting separately from shareholders of each other Fund. | ||

The principal offices of the Trusts are located at 2005 Market Street, Philadelphia, Pennsylvania 19103. You can reach the offices of the Trusts by telephone by calling 800 523-1918. The Trusts are each registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Meeting will be held at the offices of [StradleyStradley Ronon Stevens & Young, LLP, 2005 Market Street, 26th 26thFloor, Philadelphia, Pennsylvania 19103],19103, on [JulyJuly 15, 2019 at 4:00 p.m., Eastern time].time. Only Fund shareholders will be admitted to the Meeting. [TheThe Board, on behalf of each Fund, is soliciting these proxies.] This Proxy Statement is first being sent to shareholders on or about [MayMay 23,] 2019.

This Proxy Statement gives you information about the Trustees, the Proposals and other matters that you should know before voting. [TheThe Board has determined that the joint use of this Proxy Statement for the Meeting is in the best interests of each Fund and its shareholders in light of the similar matters being considered and voted on by the shareholders of the Funds].

Each Fund’s annual report to shareholders is sent to shareholders of record following the Fund’s fiscal year end. Each Fund will furnish, without charge, a copy of its most recent annual report and most recent succeeding semiannual report, if any, to a shareholder upon request. Such requests should be directed to a Fund by calling 800 523-1918 or by writing to the Fund at Attention: Shareholder Services, P.O. Box 9876, Providence, RI 02940-8076 by regular mail or 4400 Computer Drive, Westborough, MA 01581-1722 by overnight courier service. Each of Delaware Global Value Fund’s and Delaware International Value Equity Fund’s most recent annual report and most recent semiannual report are also available free of charge through the Funds’ Web site at delawarefunds.com.

Two or more shareholders of a Fund who share an address might receive only one annual report or Proxy Statement, unless the Fund has received instructions to the contrary. Each Fund will promptly send a separate copy of such documents to any shareholder upon request. To request a separate copy of an annual report or the Proxy Statement, shareholders should contact their Fund at the address and phone number set forth above.

Important information to help you understand the Proposals.

Below is a brief overview of the Proposals to be voted upon. The Proposals are described in greater detail in the enclosed Proxy Statement. Your vote is important, no matter how large or small your holdings may be.

What Proposals am I being asked to vote on?

You are being asked to vote on the following Proposals:

| 1. | To approve an amendment to the fundamental investment restriction related to industry concentration. | |

| 2. | To approve a change in the diversification status. |

The Proposals are not contingent on one another.]

Has the Board approved the Proposals?

Yes. The Board, which is the same for each of the Funds, has unanimously approved the Proposals, and recommends that you vote to approve the Proposals.]

Proposal 1: To approve an amendment to the fundamental investment restriction related to industry concentration.

What is Proposal 1?

Proposal 1 asks shareholders to approve a change in each Fund’s fundamental investment restriction related to industry concentration, so that each Fund may concentrate in the Consumer Staples economic sector.

The proposed change to each Fund’s fundamental investment restriction related to industry concentration is being undertaken in conjunction with a portfolio management change for each Fund, which is intended to provide each Fund’s shareholders with better long-term investment opportunities.

Why should shareholders approve this Proposal?

The proposed changes to each Fund’s fundamental investment restriction relating to industry concentration would provide each Fund with greater investment flexibility to enable the new portfolio management team to manage the Funds in accordance with such team’s established investment process and approach. If the proposed

change to the fundamental investment restriction is approved, management of the Funds believes that there is potential for better long-term returns for each Fund and its shareholders.

4

What is Proposal 2?

Proposal 2 asks shareholders to approve a change in the diversification status of each Fund from “diversified” to “non-diversified” as defined by the 1940 Act to allow each Fund to pursue the new portfolio management team’s approach to issuer diversification.

Why should shareholders approve this Proposal?

The proposed changes to each Fund’s diversification status would provide each Fund with greater flexibility to invest a larger percentage of each Fund’s assets in fewer issuers or in any one issuer. The proposed change would enable the new portfolio management team to focus each Fund’s investments on those securities that such portfolio managers believe are most promising. Additionally, if the proposed change to each Fund’s diversification status is approved, it would be easier for each Fund to respond to possible future investment opportunities.

Proposal 1 applies to all three Funds and relates to a change in each Fund’s fundamental investment restriction related to industry concentration. Each Fund’s current fundamental investment restriction related to industry concentration prevents the Funds from concentrating their investments. The proposed change to the fundamental investment restriction related to industry concentration would allow each Fund to concentrate its investments in the Consumer Staples economic sector, which is intended to provide Fund shareholders with better long-term investment opportunities. The Proposal to change each Fund’s fundamental investment restriction related to industry concentration is being undertaken in conjunction with a portfolio management change for each Fund.

The proposed changes to each Fund’s fundamental investment restriction relating to industry concentration would provide each Fund with greater investment flexibility to enable the new portfolio management team to manage the Funds in accordance with such team’s established investment process and approach. If the proposed change to the fundamental investment restriction is approved, management of the Funds believes that there is potential for better long-term returns for each Fund and its shareholders.

The Consumer Staples sector consists of companies that are involved in areas such as the production, manufacture, distribution, or sale of, consumer goods and services that have non-cyclical characteristics, such as tobacco, food and beverage, household goods, personal products, and non-discretionary retail. Each Fund currently has the ability to invest, but not concentrate, in the Consumer Staples sector.

Under the 1940 Act, a fund’s policy regarding concentration of investments in the securities of companies in any particular industry must be fundamental. The staff of the U.S. Securities and Exchange Commission (“SEC”) takes the position that a fund “concentrates” its investments if it invests more than 25% of its net assets (exclusive of certain items such as cash, U.S. government securities, and certain tax-exempt securities) in any particular industry. A fund is not permitted to concentrate its investments in any particular industry unless it discloses its intention to do so, and the SEC staff generally takes the position that a fund may not reserve the right to concentrate its investments in the future.

To change a fundamental investment restriction, each Fund must receive the affirmative vote of a “majority of the outstanding voting securities of the Fund,” which is defined in the 1940 Act as the lesser of: (A) 67% or more of the outstanding voting securities of the Fund present at the Meeting, if the holders of more than 50%

of the outstanding voting securities of the Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of the Fund (a “1940 Act Majority Vote”).

The current language and the proposed changes to the Funds’ fundamental investment restriction related to industry concentration are shown below:

| Fund | Current Language | Proposed Language | ||

Delaware Global Value Fund and Delaware International Value Equity Fund | Each Fund shall not [m]ake investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry, provided that this restriction does not limit the Fund from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations. | Each Fund shall not [m]ake investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry,except that the Fund shall concentrate its investments in the consumer staples sector,provided that this restriction does not limit the Fund from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations. | ||

Delaware VIP International Value Equity Series | Each Series shall not [m]ake investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry, provided that this restriction does not limit the Series from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations. | Each Series shall not [m]ake investments that will result in the concentration (as that term may be defined in the 1940 Act, any rule or order thereunder, or U.S. Securities and Exchange Commission (“SEC”) staff interpretation thereof) of its investments in the securities of issuers primarily engaged in the same industry,except that the Series shall concentrate its investments in the consumer staples sector, provided that this restriction does not limit the Series from investing in obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or in tax-exempt obligations. |

The proposed change to concentrate in the Consumer Staples economic sector presents different risks than the risks which each Fund confronts as it is currently managed. If the Consumer Staples economic sector were to underperform investments in alternative sectors, then the investment performance of the Funds would not be as strong as they otherwise would have been in the absence of the proposed change. Moreover, if some Fund shareholders are not in favor of a more concentrated

portfolio, they may sell their Fund shares and increase investor outflows. However, management of the Funds and the new portfolio management team believe these risks will be mitigated by the potential to create stronger long-term opportunities.

If shareholders approve the Proposal, it is expected that the change would be effective on or about [JulyJuly 22, 2019].

FOR THE REASONS DISCUSSED ABOVE, THE BOARD

UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR

PROPOSAL 1.]

Proposal 2 applies to all three Funds and relates to a change in each Fund’s diversification status. Proposal 2 asks shareholders to approve a change in the diversification status of each Fund from “diversified” to “non-diversified” as defined by the 1940 Act, to allow each Fund to follow the new portfolio management team’s approach to issuer diversification. Under the new portfolio management team, it is likely that each Fund will not satisfy the criteria for being “diversified” under the 1940 Act.

Under the 1940 Act, a fund must state as a fundamental policy whether it is “diversified” or “non-diversified”. Currently, each Fund is classified as a “diversified” fund. A diversified fund is limited as to the amount it may invest in any single issuer. Under the 1940 Act, a diversified fund may not, with respect to 75% of its total assets, invest in securities of any issuer if, as a result of such investment (i) more than 5% of the value of the fund’s total assets would be invested in securities of any one issuer, or (ii) the fund would hold more than 10% of the outstanding voting securities of any one issuer. This limitation generally requires a diversified fund to invest in securities issued by a minimum of 16 issuers.

The percentage limitations noted above do not apply to securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, or to securities issued by other investment companies. With respect to the remaining 25% of its total assets, a diversified fund may invest more than 5% of its total assets in the securities of one issuer. These limits apply at the time a diversified fund purchases a security; a diversified fund may exceed these limits if positions it already holds increase in value relative to the rest of the fund’s holdings. In contrast, a non-diversified fund is not subject to the limits of a diversified fund. A non-diversified fund may invest a greater percentage of its assets in a single issuer or a fewer number of issuers than a diversified fund.

The 1940 Act requires that shareholders approve a change in a fund’s fundamental investment restriction and classification from a diversified fund to a non-diversified fund. To change the related fundamental restriction, each Fund must receive the affirmative vote of a 1940 Act Majority Vote.

The current language and the proposed changes to the Funds’ current fundamental investment restriction regarding diversification are shown below:

| Fund | Current Language | Proposed Language | ||

Delaware Global Value Fund and Delaware International Value Equity Fund | Each Fund’s portfolio of assets is diversified as defined by the Investment Company Act of 1940, as amended (the “1940 Act”). The 1940 Act requires a “diversified” fund, with respect to 75% of the value of its total assets, to invest (1) no more than 5% of the value of the Fund’s total assets in the securities of any one issuer and (2) in no more than 10% of the outstanding voting securities of such issuer. This limitation generally requires a diversified fund to invest in securities issued by a minimum of 16 issuers. | Delaware International Value Equity Fund and Delaware Global Value Equity Fund are each a “non-diversified” fund as defined by the 1940 Act. A non-diversified portfolio is believed to be subject to greater risk because adverse effects on an investment held by the Fund may affect a larger portion of its overall assets and subject it to greater risks and volatility. |

Delaware VIP International Value Equity Series | Each Series’ portfolio of assets is “diversified” as defined by the Investment Company Act of 1940, as amended (the “1940 Act”). The 1940 Act requires a “diversified” fund, with respect to 75% of the value of its total assets, to invest (1) no more than 5% of the value of the fund’s total assets in the securities of any one issuer and (2) in no more than 10% of the outstanding voting securities of such issuer. This limitation generally requires a diversified fund to invest in securities issued by a minimum of 16 issuers. | Delaware VIP International Value Equity Series is a “non-diversified” fund as defined by the 1940 Act. A non-diversified portfolio is believed to be subject to greater risk because adverse effects on an investment held by the Fund may affect a larger portion of its overall assets and subject it to greater risks and volatility. |

The Proposal to change each Fund’s diversification status is being undertaken in conjunction with a portfolio management change for each Fund. The Proposal is intended to provide each Fund’s shareholders with better long-term investment opportunities.

The proposed change to each Fund’s diversification status will provide greater investment flexibility to enable the new portfolio management team to manage the Funds in accordance with the team’s investment process and approach. Additionally, the proposed change will provide greater investment flexibility to invest a larger percentage of each Fund’s assets in fewer issuers or in any one issuer. The proposed change would enable the portfolio management team to focus each Fund’s investments on those securities that the portfolio managers believe are

most promising. Additionally, if the proposed change to each Fund’s diversification status is approved, it would be easier for each Fund to respond to possible future investment opportunities.

The proposed change in diversification presents different risks than each Fund as it is currently managed. For example, because a non-diversified fund may invest its assets in the securities of fewer issuers, the Fund’s shares may become more volatile, that is, the value of the Fund’s shares may increase or decrease more rapidly than if the Fund remained diversified. Nonetheless, management of the Funds and the new portfolio management team anticipate that even as non-diversified funds, the Funds would continue to hold securities from a variety of different issuers. In addition, the portfolio managers will perform extensive analysis on all securities in an effort to manage this risk.

There is also a risk that some Fund shareholders may not be in favor of a less diversified portfolio, which could result in possible investor outflows in response to the proposed change. Also, initial portfolio turnover is anticipated to be high as the Funds transition, which creates the potential for realizing capital gains (if they are not offset by capital losses). This risk may adversely impact taxable shareholders.

If shareholders approve the Proposal, it is expected that the change would be effective on or about [JulyJuly 22, 2019].

FOR THE REASONS DISCUSSED ABOVE, THE BOARD

UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR

PROPOSAL 2.]

Only shareholders of record of the Funds at the close of business on [MayMay 16, 2019]2019 (the “Record Date”), will be entitled to notice of, and to vote at, the Meeting on the matters described in this Proxy Statement. Shareholders will be entitled to one vote for each full share and a fractional vote for each fractional share that they hold. If sufficient votes to approve a Proposal for a Fund are not received by the date of the Meeting or any reconvened Meeting following an adjournment, the Meeting or reconvened Meeting may be adjourned to permit further solicitations of proxies. The persons named as proxies on the enclosed proxy cards will vote their proxies in their discretion on questions of adjournment and any other items (other than the Proposals) that properly come before the Meeting. A majority of the votes cast by shareholders of a Fund present in person or by proxy at the Meeting (whether or not sufficient to constitute a quorum for the Fund) may adjourn the Meeting with respect to that Fund. The Meeting may also be adjourned by the Chairperson of the Meeting.

Abstentions will be counted for purposes of determining whether a quorum is present at the Meeting. Abstentions are considered as shares present at the Meeting, but are not considered votes cast. As a result, abstentions will have the same effect as a vote “Against” the Proposals, which require a “1940 Act Majority.”

You may attend the Meeting and vote in person. You may also vote by completing, signing, and returning the enclosed proxy card in the enclosed postage paid envelope, or by telephone or through the Internet. If you return your signed proxy card or vote by telephone or through the Internet, your vote will be officially cast at the Meeting in accordance with your voting instructions by the persons appointed as proxies. A proxy card is, in essence, a ballot. If you sign and date the proxy card but give no voting instructions, your shares will be voted for the Proposals. Your proxies will also be voted in the discretion of the persons appointed as proxies on any other matters that may properly come before the Meeting or any adjournment or postponement of the Meeting, although management of the Funds does not expect any such matters to come before the Meeting. If your shares are held of record by a broker/dealer and you wish to vote in person at the Meeting, you must obtain a legal proxy from the broker of record and present it at the Meeting.

You may revoke your proxy at any time for a Fund before it is voted by sending a written notice to the Fund expressly revoking your proxy, by signing and forwarding to the Fund a later-dated proxy, or by attending the Meeting and voting in person. If your shares are held in the name of your broker, you will have to make arrangements with your broker to revoke a previously executed proxy. If you wish to vote in person at the Meeting, you must obtain a legal proxy from your broker of record and present it at the Meeting.

The Board does not intend to bring any matters before the Meeting other than as described in this Proxy Statement. Because the Meeting is a special meeting, the Board does not anticipate that any other matters will be brought before the Meeting by others. However, if any other matter legally comes before the Meeting, proxies will be voted in the discretion of the persons appointed as proxies.

Only shareholders of record on the Record Date will be entitled to vote at the Meeting on the matters described in this Proxy Statement. As of [MayMay 16,] 2019, there were [ ]1,181,251 shares outstanding of Delaware Global Value Fund, , [ ]20,758,564 shares outstanding of Delaware International Value Equity Fund, and [ ]4,263,762 shares outstanding of Delaware VIP International Value Equity Series, as shown in Appendix A.

A “Quorum” is the minimum number of shares that must be present in order to conduct the Meeting. A Quorum for a particular Fund means one-third (33⅓%) of the shares of that Fund that are entitled to vote at the Meeting, present in person or represented by proxy.

To amend, adopt, or eliminate a fundamental investment restriction, which includes changes to diversification status, each Fund must receive the affirmative vote of a 1940 Act Majority Vote.

The approval of the Proposals for a Fund are not contingent on the approval of any other Proposals.] If Proposal 1 is not approved by shareholders of a Fund, the current fundamental investment restriction relating to industry concentration will

remain in effect for that Fund. If Proposal 2 is not approved by shareholders of a Fund, the current fundamental investment limitation regarding diversification will remain in effect for that Fund.

For Proposals 1 and 2, [thethe Funds’ investment manager, Delaware Management Company (“DMC”) will cover the cost of the proxy preparation, mailing, solicitation, and special meeting.]

The Fund has engaged Computershare Fund Services (“Computershare”) to solicit proxies from brokers, banks, other institutional holders and individual shareholders at an anticipated cost of approximately $175,000 for the Proposals. FeesBecause Computershare must be paid its out-of-pocket expenses, such as postage, express mail services, and courier expenses, fees and expenses may be greater depending on the effort necessary to obtain shareholder votes. The agreement with Computershare provides that Computershare shall be indemnified against certain liabilities and expenses, including liabilities under the federal securities laws.

This proxy solicitation is being made by the Board for use at the Meeting. In addition to solicitations by mail, solicitations also may be made by advertisement, telephone, telegram, facsimile transmission or other electronic media, or personal contacts. The Funds will request broker/dealer firms, custodians, nominees, and fiduciaries to forward proxy materials to the beneficial owners of the shares of record.

In addition to solicitations by mail, officers and employees of the Trusts, DMC, and their affiliates may, without extra pay, conduct additional solicitations by telephone, telecopy, and personal interviews. The Funds expect that any solicitations will be primarily by mail, but also may include telephone, telecopy, or oral solicitations.

As the Meeting date approaches, you may receive a telephone call from a representative of Computershare if your votes have not yet been received. Proxies that are obtained telephonically will be recorded in accordance with the procedures described below. These procedures are designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the Computershare representative is required to ask for each shareholder’s full name and address, and to confirm that the shareholder has received the proxy materials in the mail. If the shareholder is a corporation or other entity, the Computershare representative is required to ask for the person’s title and confirmation that the person is authorized to direct the voting

of the shares. If the information elicited matches the information previously provided to Computershare, then the Computershare representative has the responsibility to explain the voting process, read the Proposals listed on the proxy card, and ask for the shareholder’s instructions on the Proposals. Although the Computershare representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this Proxy Statement. Computershare will record the shareholder’s instructions on the card. Within 72 hours, the shareholder will be sent a letter or mailgram to confirm his or her vote and asking the shareholder to call Computershare immediately if his or her instructions are not correctly reflected in the confirmation.

Unless you have instructed the Funds not to do so, only one copy of this Proxy Statement will be mailed to multiple Fund shareholders sharing an address (a “Household”), even if more than one shareholder in a Household is a Fund shareholder of record. If you need additional copies of this Proxy Statement, if you do not want the mailing of proxy solicitation materials to be combined with those of other members of your Household in the future, or if you are receiving multiple copies and would rather receive just one copy for the Household, please contact your participating broker/dealer firm or other financial intermediary or, if you hold Fund shares directly with the Funds, you may write to the Funds by regular mail to Attention: Shareholder Services, P.O. Box 9876, Providence, RI 02940-8076, by overnight courier service to Delaware Service Center at 4400 Computer Drive, Westborough, MA 01581-1722, or by calling toll-free 800 523-1918.

The governing instruments of the Trusts do not require that the Funds hold annual meetings of shareholders. Each Fund is, however, required to call meetings of shareholders in accordance with the requirements of the 1940 Act to seek approval of new or material amendments to advisory arrangements or of a change in the fundamental investment policies, objectives or restrictions of the Fund. A Trust also would be required to hold a shareholder meeting to elect new Trustees at such time as less than a majority of the Trustees holding office have been elected by shareholders. Each Trust’s governing instruments generally provide that a shareholder meeting may be called by a majority of the Trustees, the Chair of the Board, or the President of the Trust.

Shareholders of a Fund wishing to submit proposals for inclusion in a proxy statement for a future shareholder meeting must send their written proposal to that Fund a reasonable time before the Board’s solicitation relating to that meeting is to be made. Shareholder proposals must meet certain legal requirements established by the SEC, so there is no guarantee that a shareholder’s proposal will actually be included in the next proxy statement. The persons named as proxies in future proxy materials of a Fund may exercise discretionary authority with respect to any shareholder proposal presented at any subsequent shareholder meeting if written notice of that proposal has not been received by that Fund within a reasonable period of time before the Board’s solicitation relating to that meeting is made. Written proposals with regard to a Fund should be sent to the Secretary of the Trusts, David F. Connor, at the address of the Funds given above.

Shareholders who wish to communicate to the Board may address correspondence to [ThomasThomas L. Bennett, Board Chair, c/o the Delaware Group Global & International Funds in connection with Delaware Global Value Fund and Delaware International Value Equity Fund, or c/o Delaware VIP Trust in connection with Delaware VIP International Value Equity Series at 2005 Market Street, Philadelphia, Pennsylvania 19103].19103. Shareholders may also send correspondence to any individual Trustee, c/o the Delaware Group Global & International Funds in connection with Delaware Global Value Fund and Delaware International Value Equity Fund, or c/o Delaware VIP Trust in connection with Delaware VIP International Value Equity Series at 2005 Market Street, Philadelphia, Pennsylvania 19103. Without opening any such correspondence, Trust management will promptly forward all such correspondence to the intended recipient(s).

Transfer Agency Services.Delaware Investments Fund Services Company (“DIFSC”), an affiliate of DMC, located at 2005 Market Street, Philadelphia, PA 19103-7094, serves as the Funds’ shareholder servicing, dividend disbursing, and transfer agent (the “Transfer Agent”) pursuant to a Shareholder Services Agreement. The Transfer Agent is paid a fee by the Funds for providing these services consisting of an asset-based fee and certain out-of-pocket expenses. The Transfer Agent will bill, and the Funds will pay, such compensation monthly. Omnibus and networking fees charged by financial intermediaries and subtransfer agency fees are passed on to and paid directly by the Funds. The Transfer Agent’s compensation is fixed each year and approved by the Board, including a majority of the Independent Trustees.

BNY Mellon Investment Servicing (US) Inc. (“BNYMIS”), 4400 Computer Drive, Westborough, Massachusetts 01581, provides subtransfer agency services to the Funds. In connection with these services, BNYMIS administers the overnight investment of cash pending investment in the Funds or payment of redemptions. The proceeds of this investment program are used to offset the Funds’ transfer agency expenses.

Fund AccountantsAccountants.. The Bank of New York Mellon (“BNY Mellon”), 240 Greenwich Street, New York, NY 10286-0001, provides fund accounting and financial administration services to the Funds. Those services include performing functions related to calculating the Funds’ net asset values (“NAVs”) and providing financial reporting information, regulatory compliance testing and other related accounting services. For these services, the Funds pay BNY Mellon an asset-based fee, subject to certain fee minimums plus certain out-of-pocket expenses and transactional charges.

DIFSC provides fund accounting and financial administration oversight services to the Funds. Those services include overseeing the Funds’ pricing process, the calculation and payment of fund expenses, and financial reporting in shareholder reports, registration statements and other regulatory filings. DIFSC also manages the process for the payment of dividends and distributions and the dissemination of Fund NAVs and performance data. For these services, the Funds pay DIFSC an asset-based fee, plus certain out-of-pocket expenses and transactional charges. The fees payable to BNY Mellon and DIFSC under the service agreements described above will be allocated among all funds in the Delaware Funds on a relative NAV basis.

Distribution ServicesServices.. Delaware Distributors, L.P., located at 2005 Market Street, Philadelphia, PA 19103-7094, serves as the national distributor of the Funds’ shares. The Distributor is an affiliate of DMC. The Distributor has agreed to use its best efforts to sell shares of the Funds. Shares of the Funds are offered on a continuous basis by the Distributor and may be purchased through authorized investment dealers or directly by contacting the Distributor or the Trusts.

No Fund paid any brokerage commissions for portfolio securities to any broker that is an affiliate (or an affiliate of an affiliate) of the Funds, DMC, DDLP, or DIFSC during the Funds’ most recently completed fiscal year.

As of [AprilApril 30, 2019],2019, the officers and Trustees of each Trust, as a group, owned less than 1% of the outstanding voting shares of each Fund or class thereof, [except as noted in Appendix B].

To the best knowledge of the Trusts, as of [AprilApril 30, 2019],2019, no person, except as set forth in Appendix C,B, owned of record 5% or more of the outstanding shares of any Fund. Except as noted in Appendix C,B, the Trusts have no knowledge of beneficial ownership of 5% or more of the outstanding shares of any class of any Fund.

APPENDIX A — NUMBER OF SHARES OF EACH FUND OUTSTANDING

APPENDIX B — 1% SHARE OWNERSHIP

AS OF [APRIL 30, 2019]

| Fund Name | Class | Shares Outstanding | ||

| Delaware Global Value Fund | A | 955,157.146 | ||

| Delaware Global Value Fund | C | 107,546.874 | ||

| Delaware Global Value Fund | ||||

| Institutional | 118,546.778 | |||

| Delaware International Value Equity Fund | A | 4,517,463.771 | ||

| Delaware International Value Equity Fund | C | 589,366.974 | ||

| Delaware International Value Equity Fund | R | 263,020.486 | ||

| Delaware International Value Equity Fund | Institutional | 15,388,579.348 | ||

| Delaware International Value Equity Fund | R6 | 133.785 | ||

Delaware VIP®International Value Equity Series | Standard | 65,121.583 | ||

Delaware VIP®International Value Equity Series | Service | 4,198,640.232 |

The following table shows, as of [May 16, 2019],April 30, 2019, the accounts of each class of each Fund that own of record 5% or more of such class.

| Fund Name | Class | Shareholders Name and Address | Total Shares | Percentage | ||||

| DELAWARE GLOBAL | A | NATIONAL FINANCIAL | 140,241.025 | 14.59% | ||||

| VALUE FUND | SERVICES LLC | |||||||

| CLASS A | FBO OUR CUSTOMERS | |||||||

| ATTN MUTUAL | ||||||||

| FUNDS DEPARTMENT | ||||||||

| 499 WASHINGTON BLVD FL4 | ||||||||

| JERSEY CITY NJ 07310 | ||||||||

| DELAWARE GLOBAL | A | PERSHING LLC | 68,221.895 | 7.10% | ||||

| VALUE FUND | 1 PERSHING PLAZA JERSEY CITY | |||||||

| CLASS A | NJ 07399-0002 | |||||||

| DELAWARE GLOBAL | A | WELLS FARGO CLEARING | 89,927.808 | 9.35% | ||||

| VALUE FUND | SVCS LLC | |||||||

| CLASS A | SPECIAL CUSTODY ACCT | |||||||

| FOR THE EXCLUSIVE BENEFIT | ||||||||

| OF CUSTOMER | ||||||||

| 2801 MARKET ST SAINT LOUIS | ||||||||

| MO 63103-2523 | ||||||||

| DELAWARE GLOBAL | C | MLPF&S FOR THE SOLE | 12,617.358 | 11.74% | ||||

| VALUE FUND | BENEFIT OF ITS CUSTOMERS | |||||||

| CLASS C | ATTENTION: FUND ADMIN | |||||||

| 4800 DEER LAKE DR E FL2 | ||||||||

| JACKSONVILLE FL 32246-6484 | ||||||||

| DELAWARE GLOBAL | C | WELLS FARGO CLEARING | 8,333.489 | 7.75% | ||||

| VALUE FUND | SVCS LLC | |||||||

| CLASS C | SPECIAL CUSTODY ACCT | |||||||

| FOR THE EXCLUSIVE BENEFIT | ||||||||

| OF CUSTOMER | ||||||||

| 2801 MARKET ST SAINT LOUIS | ||||||||

| MO 63103-2523 | ||||||||

| DELAWARE GLOBAL | C | RAYMOND JAMES OMNIBUS FOR | 6,039.558 | 5.62% | ||||

| VALUE FUND | MUTUAL FUNDS | |||||||

| CLASS C | ATTN COURTNEY WALLER | |||||||

| 880 CARILLON PARKWAY ST | ||||||||

| PETERSBURG FL 33713 | ||||||||

| DELAWARE GLOBAL | C | CHARLES SCHWAB & CO INC | 34,270.507 | 31.88% | ||||

| VALUE FUND | SPECIAL CUSTODY ACCT | |||||||

| CLASS C | FBO CUSTOMERS | |||||||

| ATTN MUTUAL FUNDS | ||||||||

| 211 MAIN ST SAN FRANCISCO | ||||||||

| CA 94105 |

| Fund Name | Class | Shareholders Name and Address | Total Shares | Percentage | ||||

| DELAWARE GLOBAL | I | NATIONAL FINANCIAL | 70,259.913 | 60.16% | ||||

| VALUE FUND CLASS I | SERVICES LLC | |||||||

| FBO OUR CUSTOMERS | ||||||||

| ATTN MUTUAL | ||||||||

| FUNDS DEPARTMENT | ||||||||

| 499 WASHINGTON BLVD FL4 | ||||||||

| JERSEY CITY NJ 07310 | ||||||||

| DELAWARE GLOBAL | I | UBS WM USA | 7,156.722 | 6.13% | ||||

| VALUE FUND CLASS I | SPEC CDY A/C EXL BEN | |||||||

| CUSTOMERS OF UBSFSI | ||||||||

| 1000 HARBOR BLVD | ||||||||

| WEEHAWKEN NJ 07086 | ||||||||

| DELAWARE GLOBAL | I | RAYMOND JAMES | 13,246.679 | 11.34% | ||||

| VALUE FUND CLASS I | OMNIBUS FOR MUTUAL FUNDS | |||||||

| ATTN COURTNEY WALLER | ||||||||

| 880 CARILLON PARKWAY ST | ||||||||

| PETERSBURG FL 33713 | ||||||||

| DELAWARE | A | MORGAN STANLEY SMITH | 624,488.271 | 13.77% | ||||

| INTERNATIONAL | BARNEY LLC | |||||||

| VALUE EQUITY | FOR THE EXCLUSIVE BENEFIT OF | |||||||

| CLASS A | ITS CUSTOMERS | |||||||

| 1 NEW YORK PLAZA FL 12 NEW | ||||||||

| YORK NY 10004-1901 | ||||||||

| DELAWARE | A | NATIONAL FINANCIAL | 775,223.196 | 17.10% | ||||

| INTERNATIONAL | SERVICES LLC | |||||||

| VALUE EQUITY | FBO OUR CUSTOMERS | |||||||

| CLASS A | ATTN MUTUAL | |||||||

| FUNDS DEPARTMENT | ||||||||

| 499 WASHINGTON BLVD FL4 | ||||||||

| JERSEY CITY NJ 07310 | ||||||||

| DELAWARE | A | WELLS FARGO CLEARING | 435,417.826 | 9.60% | ||||

| INTERNATIONAL | SVCS LLC | |||||||

| VALUE EQUITY | SPECIAL CUSTODY ACCT FOR | |||||||

| CLASS A | THE EXCLUSIVE BENEFIT | |||||||

| OF CUSTOMER | ||||||||

| 2801 MARKET ST SAINT LOUIS | ||||||||

| MO 63103-2523 | ||||||||

| DELAWARE | C | MORGAN STANLEY SMITH | 119,075.041 | 20.09% | ||||

| INTERNATIONAL | BARNEY LLC | |||||||

| VALUE EQUITY | FOR THE EXCLUSIVE BENEFIT OF | |||||||

| CLASS C | ITS CUSTOMERS | |||||||

| 1 NEW YORK PLAZA FL 12 NEW | ||||||||

| YORK NY 10004-1901 |

| Fund Name | Class | Shareholders Name and Address | Total Shares | Percentage | ||||

| DELAWARE | C | NATIONAL FINANCIAL | 62,167.855 | 10.49% | ||||

| INTERNATIONAL | SERVICES LLC | |||||||

| VALUE EQUITY | FBO OUR CUSTOMERS ATTN | |||||||

| CLASS C | MUTUAL FUNDS DEPARTMENT | |||||||

| 499 WASHINGTON BLVD FL4 | ||||||||

| JERSEY CITY NJ 07310 | ||||||||

| DELAWARE | C | MLPF&S FOR THE SOLE | 43,697.913 | 7.37% | ||||

| INTERNATIONAL | BENEFIT OF ITS CUSTOMERS | |||||||

| VALUE EQUITY | ATTENTION: FUND ADMIN | |||||||

| CLASS C | 4800 DEER LAKE DR E FL2 | |||||||

| JACKSONVILLE FL 32246-6484 | ||||||||

| DELAWARE | C | WELLS FARGO CLEARING | 183,999.039 | 31.04% | ||||

| INTERNATIONAL | SVCS LLC | |||||||

| VALUE EQUITY | SPECIAL CUSTODY ACCT FOR | |||||||

| CLASS C | THE EXCLUSIVE BENEFIT | |||||||

| OF CUSTOMER | ||||||||

| 2801 MARKET ST SAINT LOUIS | ||||||||

| MO 63103-2523 | ||||||||

| DELAWARE | C | UBS WM USA | 63,411.361 | 10.70% | ||||

| INTERNATIONAL | SPEC CDY A/C EXL BEN | |||||||

| VALUE EQUITY | CUSTOMERS OF UBSFSI | |||||||

| CLASS C | 1000 HARBOR BLVD | |||||||

| WEEHAWKEN NJ 07086 | ||||||||

| DELAWARE | I | MORGAN STANLEY SMITH | 9,403,974.031 | 60.58% | ||||

| INTERNATIONAL | BARNEY LLC | |||||||

| VALUE EQUITY | FOR THE EXCLUSIVE BENEFIT | |||||||

| CLASS I | OF ITS CUSTOMERS | |||||||

| 1 NEW YORK PLAZA FL 12 NEW | ||||||||

| YORK NY 10004-1901 | ||||||||

| DELAWARE | I | NATIONAL FINANCIAL | 904,429.771 | 5.83% | ||||

| INTERNATIONAL | SERVICES LLC | |||||||

| VALUE EQUITY | FBO OUR CUSTOMERS | |||||||

| CLASS I | ATTN MUTUAL | |||||||

| FUNDS DEPARTMENT | ||||||||

| 499 WASHINGTON BLVD FL4 | ||||||||

| JERSEY CITY NJ 07310 | ||||||||

| DELAWARE | I | WELLS FARGO CLEARING | 1,377,340.189 | 8.87% | ||||

| INTERNATIONAL | SVCS LLC | |||||||

| VALUE EQUITY | SPECIAL CUSTODY ACCT FOR | |||||||

| CLASS I | THE EXCLUSIVE BENEFIT OF | |||||||

| CUSTOMER | ||||||||

| 2801 MARKET ST SAINT LOUIS | ||||||||

| MO 63103-2523 |

| Fund Name | Class | Shareholders Name and Address | Total Shares | Percentage | ||||

| DELAWARE | I | AMERICAN ENTERPRISE | 895,400.726 | 5.77% | ||||

| INTERNATIONAL | INVESTMENT SERVICES | |||||||

| VALUE EQUITY | 707 2ND AVE SOUTH | |||||||

| CLASS I | MINNEAPOLIS MN 55402-2405 | |||||||

| DELAWARE | I | UBS WM USA | 1,216,608.691 | 7.84% | ||||

| INTERNATIONAL | SPEC CDY A/C EXL BEN | |||||||

| VALUE EQUITY | CUSTOMERS OF UBSFSI | |||||||

| CLASS I | 1000 HARBOR BLVD | |||||||

| WEEHAWKEN NJ 07086 | ||||||||

| DELAWARE | R | MLPF&S FOR THE SOLE | 47,414.007 | 17.99% | ||||

| INTERNATIONAL | BENEFIT OF ITS CUSTOMERS | |||||||

| VALUE EQUITY | ATTENTION: FUND ADMIN | |||||||

| CLASS R | 4800 DEER LAKE DR E FL2 | |||||||

| JACKSONVILLE FL 32246-6484 | ||||||||

| DELAWARE | R | ASCENSUS TRUST COMPANY | 18,662.994 | 7.08% | ||||

| INTERNATIONAL | FBO ENTERTAINMENT SERVICES | |||||||

| VALUE EQUITY | GROUP INC | |||||||

| CLASS R | P.O. BOX 10758 FARGO ND 58106 | |||||||

| DELAWARE | R | MID ATLANTIC TRUST | 14,756.222 | 5.60% | ||||

| INTERNATIONAL | COMPANY FBO MILLER BOAT | |||||||

| VALUE EQUITY | LINE INC | |||||||

| CLASS R | 401(K) PROFIT SHARING PLAN | |||||||

| 1251 WATERFRONT PLACE STE | ||||||||

| 525 PITTSBURGH PA 15222 | ||||||||

| DELAWARE | 6 | DELAWARE MANAGEMENT | 133.785 | 100.00% | ||||

| INTERNATIONAL | BUSINESS TRUST-DIA | |||||||

| VALUE EQUITY R6 | ATTN: RICK SALUS | |||||||

| 2005 MARKET ST FL 9 | ||||||||

| PHILADELPHIA PA 19103-7007 | ||||||||

| VIP INTL VALUE | S | GREAT-WEST LIFE & ANNUITY | 6,720.376 | 10.51% | ||||

| EQUITY SERIES | FBO VARIABLE ANNUITY C/O | |||||||

| SERVICE CLASS | GREAT WEST LIFE & ANNUITY | |||||||

| INSURANCE COMPANY | ||||||||

| 8515 E ORCHARD RD 2T2 | ||||||||

| GREENWOOD VILLAGE CO 80111 | ||||||||

| VIP INTL VALUE | S | GREAT-WEST LIFE & | 44,292.913 | 69.29% | ||||

| EQUITY SERIES | ANNUITY FBO VARIABLE | |||||||

| SERVICE CLASS | ANNUITY SMARTTRACK | |||||||

| 8515 E ORCHARD RD 2T2 | ||||||||

| GREENWOOD VILLAGE CO 80111 |

| Fund Name | Class | Shareholders Name and Address | Total Shares | Percentage | ||||

| VIP INTL VALUE | S | GREAT-WEST LIFE & ANN INS | 11,645.842 | 18.22% | ||||

| EQUITY SERIES | CO OF NY | |||||||

| SERVICE CLASS | FBO VARIABLE ANNUITY 2 | |||||||

| 8515 E ORCHARD RD 2T2 | ||||||||

| GREENWOOD VILLAGE CO 80111 | ||||||||

| VIP INTL VALUE | V | TIAA CREF LIFE SEPARATE | 3,743,801.213 | 89.32% | ||||

| EQUITY SERIES | ACCOUNT LIFE INSURANCE | |||||||

| STANDARD CLASS | CO 8500 ANDREW CARNEGIE | |||||||

| BLVD # E3/N6 | ||||||||

| CHARLOTTE NC 28262-8500 |

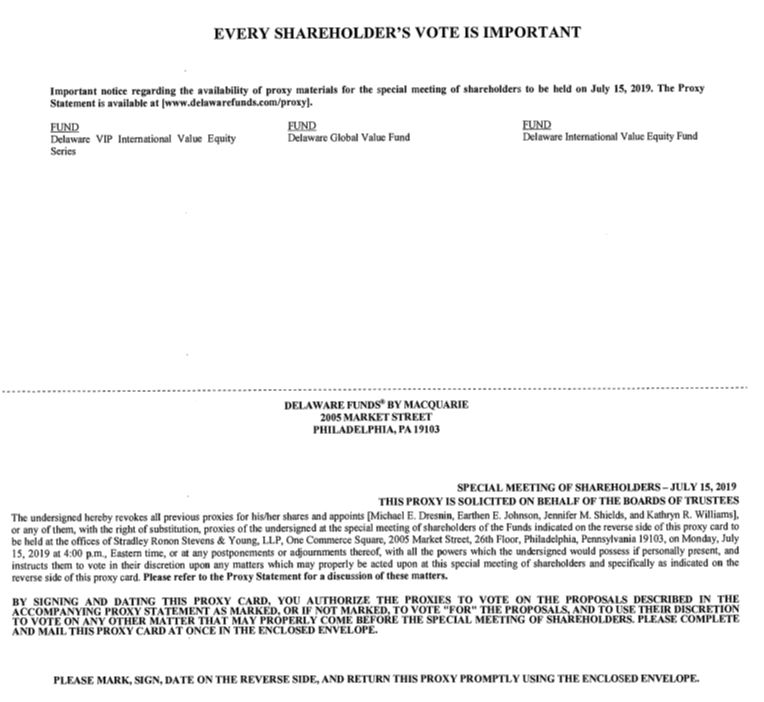

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| VOTE ON THE INTERNET |

| VOTE BY PHONE |

| VOTE BY MAIL |

Please detach at perforation before mailing.

| DELAWARE INTERNATIONAL VALUE EQUITY FUND JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 15, 2019 |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES.

The undersigned hereby revokes all previous proxies for his/her shares and appoints Michael E. Dresnin, Earthen E. Johnson, Jennifer M. Shields and Kathryn R. Williams, or any of them, with the right of substitution, proxies of the undersigned at the joint special meeting of shareholders of Delaware International Value Equity Fund a series of Delaware Group® Global & International Funds to be held at the offices of Stradley Ronon Stevens & Young, LLP, One Commerce Square, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, on Monday, July 15, 2019 at 4:00 p.m., Eastern time, or at any postponements or adjournments thereof, with all the powers which the undersigned would possess if personally present, and instructs them to vote in their discretion upon any matters which may properly be acted upon at this joint special meeting of shareholders and specifically as indicated on the reverse side of this Proxy Card.Please refer to the Proxy Statement for a discussion of these matters.

BY SIGNING AND DATING THIS PROXY CARD, YOU AUTHORIZE THE PROXIES TO VOTE ON THE PROPOSALS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AS MARKED, OR IF NOT MARKED, TO VOTE "FOR" THE PROPOSALS, AND TO USE THEIR DISCRETION TO VOTE ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE JOINT SPECIAL MEETING OF SHAREHOLDERS. PLEASE COMPLETE AND MAIL THIS PROXY CARD AT ONCE IN THE ENCLOSED ENVELOPE.

| VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 | ||

PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

DIV_30650_052019

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Joint Special Shareholders Meeting to Be Held on July 15, 2019.

The Proxy Statement for this meeting is available at:

www.delawarefunds.com/proxy

Please detach at perforation before mailing.

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: | X |

| Proposals |

| FOR | AGAINST | ABSTAIN | |||||

1. | To approve an amendment to the fundamental investment restriction related to industry concentration. | ☐ | ☐ | ☐ | |||

2. | To approve a change in the diversification status. | ☐ | ☐ | ☐ |

| Authorized Signatures – This section must be completed for your vote to be counted. – Sign and Date Below |

| Note: | Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

| Date (mm/dd/yyyy) – Please print date below | Signature 1 – Please keep signature within the box | Signature 2 – Please keep signature within the box | ||

| / / |

| Scanner bar code |

| xxxxxxxxxxxxxx | DIV 30650 | M xxxxxxxx |  |

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| EASY VOTING OPTIONS: | |

| VOTE ON THE INTERNET |

| VOTE BY PHONE |

| VOTE BY MAIL |

Please detach at perforation before mailing.

| DELAWARE FUNDS® BY MACQUARIE DELAWARE GLOBAL VALUE FUND JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 15, 2019 |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES.

The undersigned hereby revokes all previous proxies for his/her shares and appoints Michael E. Dresnin, Earthen E. Johnson, Jennifer M. Shields and Kathryn R. Williams, or any of them, with the right of substitution, proxies of the undersigned at the joint special meeting of shareholders of Delaware Global Value Fund a series of Delaware Group® Global & International Funds to be held at the offices of Stradley Ronon Stevens & Young, LLP, One Commerce Square, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, on Monday, July 15, 2019 at 4:00 p.m., Eastern time, or at any postponements or adjournments thereof, with all the powers which the undersigned would possess if personally present, and instructs them to vote in their discretion upon any matters which may properly be acted upon at this joint special meeting of shareholders and specifically as indicated on the reverse side of this Proxy Card. Please refer to the Proxy Statement for a discussion of these matters.

BY SIGNING AND DATING THIS PROXY CARD, YOU AUTHORIZE THE PROXIES TO VOTE ON THE PROPOSALS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AS MARKED, OR IF NOT MARKED, TO VOTE “FOR” THE PROPOSALS, AND TO USE THEIR DISCRETION TO VOTE ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE JOINT SPECIAL MEETING OF SHAREHOLDERS. PLEASE COMPLETE AND MAIL THIS PROXY CARD AT ONCE IN THE ENCLOSED ENVELOPE.

| VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 | ||

PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

DGV_30650_052019

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Joint Special Shareholders Meeting to Be Held on July 15, 2019.

The Proxy Statement for this meeting is available at:

www.delawarefunds.com/proxy

Please detach at perforation before mailing.

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: | X |

| Proposals |

| FOR | AGAINST | ABSTAIN | |||||

| 1. | To approve an amendment to the fundamental investment restriction related to industry concentration. | ☐ | ☐ | ☐ | |||

| 2. | To approve a change in the diversification status. | ☐ | ☐ | ☐ |

| Authorized Signatures – This section must be completed for your vote to be counted. – Sign and Date Below |

| Note: | Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

| Date (mm/dd/yyyy) – Please print date below | Signature 1 – Please keep signature within the box | Signature 2 – Please keep signature within the box | ||

| / / |

| Scanner bar code |

| xxxxxxxxxxxxxx | DGV 30650 | M xxxxxxxx |  |

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| EASY VOTING OPTIONS: | |

| VOTE ON THE INTERNET |

| VOTE BY PHONE |

| VOTE BY MAIL |

Please detach at perforation before mailing.

| DELAWARE FUNDS® BY MACQUARIE DELAWARE VIP® INTERNATIONAL VALUE EQUITY SERIES JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 15, 2019 |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES.

The undersigned hereby revokes all previous proxies for his/her shares and appoints Michael E. Dresnin, Earthen E. Johnson, Jennifer M. Shields and Kathryn R. Williams, or any of them, with the right of substitution, proxies of the undersigned at the joint special meeting of shareholders of Delaware VIP® International Value Equity Series, a series of a series of Delaware VIP® Trust to be held at the offices of Stradley Ronon Stevens & Young, LLP, One Commerce Square, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, on Monday, July 15, 2019 at 4:00 p.m., Eastern time, or at any postponements or adjournments thereof, with all the powers which the undersigned would possess if personally present, and instructs them to vote in their discretion upon any matters which may properly be acted upon at this joint special meeting of shareholders and specifically as indicated on the reverse side of this Proxy Card.Please refer to the Proxy Statement for a discussion of these matters.

BY SIGNING AND DATING THIS PROXY CARD, YOU AUTHORIZE THE PROXIES TO VOTE ON THE PROPOSALS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AS MARKED, OR IF NOT MARKED, TO VOTE "FOR" THE PROPOSALS, AND TO USE THEIR DISCRETION TO VOTE ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE JOINT SPECIAL MEETING OF SHAREHOLDERS. PLEASE COMPLETE AND MAIL THIS PROXY CARD AT ONCE IN THE ENCLOSED ENVELOPE.

| VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 | ||

PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

VIP_30651_052019

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Joint Special Shareholders Meeting to Be Held on July 15, 2019.

The Proxy Statement for this meeting is available at:

www.delawarefunds.com/proxy

Please detach at perforation before mailing.

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: | X |

| Proposals |

| FOR | AGAINST | ABSTAIN | |||||

| 1. | To approve an amendment to the fundamental investment restriction related to industry concentration. | ☐ | ☐ | ☐ | |||

| 2. | To approve a change in the diversification status. | ☐ | ☐ | ☐ |

| Authorized Signatures – This section must be completed for your vote to be counted. – Sign and Date Below |

| Note: | Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

| Date (mm/dd/yyyy) – Please print date below | Signature 1 – Please keep signature within the box | Signature 2 – Please keep signature within the box | ||

| / / |

| Scanner bar code |

| xxxxxxxxxxxxxx | VIP1 30651 | M xxxxxxxx |  |

EVERY CONTRACT OWNER’S VOTE IS IMPORTANT

| EASY VOTING OPTIONS: | |

| VOTE ON THE INTERNET |

| VOTE BY PHONE |

| VOTE BY MAIL |

Please detach at perforation before mailing.

| DELAWARE FUNDS® BY MACQUARIE DELAWARE VIP® INTERNATIONAL VALUE EQUITY SERIES JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 15, 2019 |

INSURANCE COMPANY DROP-IN

The above-referenced insurance company (the “Company”) is using this Voting Instruction Card to solicit voting instructions from its contract owners who hold unit values in a separate account of the Company that invests in the above-named fund.

The undersigned contract owner instructs the Company to vote, at the Joint Special Meeting of Shareholders and at any adjournments or postponements thereof (the “Meeting”), all shares of the Fund attributable to his or her contract or interest in the relevant separate account as directed. The undersigned acknowledges receipt of the Proxy Statement.

If you sign on the reverse side but do not mark instructions, the Company will vote all shares of the Fund attributable to your account value FOR the proposals. If you fail to return this Voting Instruction Card, the Company may vote all shares attributable to your account value in proportion to the timely voting instructions actually received from contract owners in the separate account.

| VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-866-298-8476 | ||

18PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS VOTING INSTRUCTION CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

VIP_30651_VI_052019

EVERY CONTRACT OWNER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the Please detach at perforation before mailing. THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS. Please sign exactly as your name(s) appear(s) on this Voting Instruction Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature.TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X

Proposals FOR AGAINST ABSTAIN 1. To approve an amendment to the fundamental investment restriction related to industry concentration. ☐ ☐ ☐ 2. To approve a change in the diversification status. ☐ ☐ ☐

Authorized Signatures – This section must be completed for your vote to be counted. – Sign and Date Below Note: Date (mm/dd/yyyy) – Please print date below Signature 1 – Please keep signature within the box Signature 2 – Please keep signature within the box / / Scanner bar code

xxxxxxxxxxxxxx VIP2 30651 M xxxxxxxx